A much over due post and activity from me, so while I have some time I hope to get some posts up for you all over the next few days.

Best wishes to you and your families while you enjoy a deserved break.

Doc

Thursday, 24 December 2015

Sunday, 21 June 2015

EUR/JPY

Monthly chart.

First put obvious areas on the chart to show where price has been and where it is likely headed to for a target. Here we see a rapid and rather violent decline in price and as rapidly left supply, it approached demand in a sheepish manner. Note how price slowed down and wound itself into tighter falling ranges as demand loomed close. This happens on all times frames and while it is not the only approach used, it tells us a story. Here it meant the pro's were waiting for the time to reverse the market after a large drop in price, the best time to do it. Once the emotional card is played the herd will follow blindly.

The reversal came almost as swift as the decline and only human thinking causes this. Something will fall in price faster than it rises, humans are by nature negative when it comes to value.

From this chart we know that where price is now, its path is still bullish and the target has enough free space about the most recent supply to still be wide enough for profit to interest pro money.

Weekly chart.

At the bottom of the chart is the box showing demand and the obvious move up from that. The blue line shows us where price has in the very recent past found enough buyers to allow a clean and obvious place to move away from. The small box above that blue line is a decision point where price hesitated after it broke the small recent supply as well. This was a test to see will sellers come back into the market and this is also done on all time frames and all markets, it will be done in other places too to test for the strength of the opposing force. Its a smart way to get in at low cost, and get out at low cost if your wrong. Only pro money will do this because the herd and neither organised or have sufficient funds to keep a move going.

Above price is thin box showing the next batch of sell orders. There is nothing to hold us up if we wanted to take this long after we see some kind of support and continuation. 650 odd points is a good profit margin no matter what your account size once its traded sensibly. But before price goes up, it first has to come down and the same holds true for opposite trade.

Daily chart.

The most commonly viewed time frame in trading, its closing price is telling.

The only new item drawn on this chart is a blue line, it was not possible to see this level of detail on higher tinme frames and it gives us some more intel. It shows up price hit a tiny but significant enough supply area to stop price in its tracks and send it off into a range for a few days. We also see price made a second attempt to push through and once again at an even lower price than the blue was enough to send it back for the past two trading days.

Now the pro's are left with a situation where pushign hard from here could cost a lot of money and then will could try a exploit the weakness of the herd. They could sell short from here for a day or two, three etc.....and once price hits the lower box, buy into this and send it back up with enough very low cost long orders and build enough momentum to get through the blue line.

Given price is now in a range and the longer it stays in the range, the more spectacular the break will be. The bulls dont have the advantage here yet given there is still some supply over head and until thats broken they have a hard job. Another trick that would also work is a large spike through the rest of supply and close lower. That will clear out the last of the short orders and stop out the same orders once the pull back is deep enough. You can do great things in the market if you have the wallet for it.

4hr chart.

The last comment I made above is fleshed out a little here. If price cant push though the blue line then it can come back down the bottom of the range shown by the black line and see can it find more long orders to push higher, or better again is to break that line and get more folks short and bring it down as close as possible to the lower box. The herd will at this stage be fully commited short allowing enough time and orders to go long placed into that selling.

There is around 110 points between the line and the top of the box and that can be stretched into what will look like a very convincing few days of selling.

First put obvious areas on the chart to show where price has been and where it is likely headed to for a target. Here we see a rapid and rather violent decline in price and as rapidly left supply, it approached demand in a sheepish manner. Note how price slowed down and wound itself into tighter falling ranges as demand loomed close. This happens on all times frames and while it is not the only approach used, it tells us a story. Here it meant the pro's were waiting for the time to reverse the market after a large drop in price, the best time to do it. Once the emotional card is played the herd will follow blindly.

The reversal came almost as swift as the decline and only human thinking causes this. Something will fall in price faster than it rises, humans are by nature negative when it comes to value.

From this chart we know that where price is now, its path is still bullish and the target has enough free space about the most recent supply to still be wide enough for profit to interest pro money.

Weekly chart.

At the bottom of the chart is the box showing demand and the obvious move up from that. The blue line shows us where price has in the very recent past found enough buyers to allow a clean and obvious place to move away from. The small box above that blue line is a decision point where price hesitated after it broke the small recent supply as well. This was a test to see will sellers come back into the market and this is also done on all time frames and all markets, it will be done in other places too to test for the strength of the opposing force. Its a smart way to get in at low cost, and get out at low cost if your wrong. Only pro money will do this because the herd and neither organised or have sufficient funds to keep a move going.

Above price is thin box showing the next batch of sell orders. There is nothing to hold us up if we wanted to take this long after we see some kind of support and continuation. 650 odd points is a good profit margin no matter what your account size once its traded sensibly. But before price goes up, it first has to come down and the same holds true for opposite trade.

Daily chart.

The most commonly viewed time frame in trading, its closing price is telling.

The only new item drawn on this chart is a blue line, it was not possible to see this level of detail on higher tinme frames and it gives us some more intel. It shows up price hit a tiny but significant enough supply area to stop price in its tracks and send it off into a range for a few days. We also see price made a second attempt to push through and once again at an even lower price than the blue was enough to send it back for the past two trading days.

Now the pro's are left with a situation where pushign hard from here could cost a lot of money and then will could try a exploit the weakness of the herd. They could sell short from here for a day or two, three etc.....and once price hits the lower box, buy into this and send it back up with enough very low cost long orders and build enough momentum to get through the blue line.

Given price is now in a range and the longer it stays in the range, the more spectacular the break will be. The bulls dont have the advantage here yet given there is still some supply over head and until thats broken they have a hard job. Another trick that would also work is a large spike through the rest of supply and close lower. That will clear out the last of the short orders and stop out the same orders once the pull back is deep enough. You can do great things in the market if you have the wallet for it.

4hr chart.

The last comment I made above is fleshed out a little here. If price cant push though the blue line then it can come back down the bottom of the range shown by the black line and see can it find more long orders to push higher, or better again is to break that line and get more folks short and bring it down as close as possible to the lower box. The herd will at this stage be fully commited short allowing enough time and orders to go long placed into that selling.

There is around 110 points between the line and the top of the box and that can be stretched into what will look like a very convincing few days of selling.

US Dollar

Some heads up on the US Dollar. Here is the weekly chart on the USD index and something is starting to come undone. Note the run up, it looks as parabolic as many currencies did prior to the crash. Some of this move has been supported by policy where injections of cash into the economy has removed much of the incentive to short. Perhaps until now.

You can see clear change in pace by the bulls and no new highs made for some time, and also look at their last attempt to make a new high. It was sold inot strongly by bears who have been missing in the market for a long time and now start showing up. It is obvious that any further attempts by pro money to take this higher is going to result in a major bear/bull fight and will cost a pretty penny.

The last candle shows the week closed on a bear candle with some buying/profit taking into the close. Some retracement up from here for further short selling would be wise, the herd will need convincing this is not falling and get major media outlets to pimp it accordingly. The big picture is not one where I can see a buying opportunity for some time until prices reaches much lower prices.

Any potential short that setup have clear targets below. The lowest one is the origin of this move and any bounce there may well fizzle out because such a drop in price wont see many buyers coming in.

Daily chart.

A, no new high and immediate selling.

B, bears counter bullish buying immediately.

C, retest of the B move, success.

D, Broke what was historic buying.

E, to the left and down a little. even this buying has been broken.

Box on the very bottom is the last place for buying to come back in and as yet its too early to judge. But would you be a buyer when you look left on this time frame and higher?

4hr chart.

This is about as close as makes sense at the moment. C, on top shows how quickly the bulls got wiped out. There are lots of places where bulls could have reacted but all we see is bears fully in control.

The black line on the bottom shows near term demand resulted in a very small rally on the last trading day of the week. And even this has closed into its mini demand area with no concivtion or follow through to make a new high.

Tie all this intel with all the other currencies against the US Dollar and you will soon find out if major turns in the market are setting up. I get the feeling that the Greek deal will be the news that will hide any fact of the obvious happening and have something to blame it on, rather than it being normal market forces.

Order flow is not spoken about much in the media, its too boring and too obvious. Sensional news stories is what sells.

I dont post trades anymore, but here is just one to show that there are opportunities even when forex has yet setup with good trades. 32, S&P500 shorts and target just about there. Small time frame trades like that are littered on all charts.

You can see clear change in pace by the bulls and no new highs made for some time, and also look at their last attempt to make a new high. It was sold inot strongly by bears who have been missing in the market for a long time and now start showing up. It is obvious that any further attempts by pro money to take this higher is going to result in a major bear/bull fight and will cost a pretty penny.

The last candle shows the week closed on a bear candle with some buying/profit taking into the close. Some retracement up from here for further short selling would be wise, the herd will need convincing this is not falling and get major media outlets to pimp it accordingly. The big picture is not one where I can see a buying opportunity for some time until prices reaches much lower prices.

Any potential short that setup have clear targets below. The lowest one is the origin of this move and any bounce there may well fizzle out because such a drop in price wont see many buyers coming in.

Daily chart.

A, no new high and immediate selling.

B, bears counter bullish buying immediately.

C, retest of the B move, success.

D, Broke what was historic buying.

E, to the left and down a little. even this buying has been broken.

Box on the very bottom is the last place for buying to come back in and as yet its too early to judge. But would you be a buyer when you look left on this time frame and higher?

4hr chart.

This is about as close as makes sense at the moment. C, on top shows how quickly the bulls got wiped out. There are lots of places where bulls could have reacted but all we see is bears fully in control.

The black line on the bottom shows near term demand resulted in a very small rally on the last trading day of the week. And even this has closed into its mini demand area with no concivtion or follow through to make a new high.

Tie all this intel with all the other currencies against the US Dollar and you will soon find out if major turns in the market are setting up. I get the feeling that the Greek deal will be the news that will hide any fact of the obvious happening and have something to blame it on, rather than it being normal market forces.

Order flow is not spoken about much in the media, its too boring and too obvious. Sensional news stories is what sells.

I dont post trades anymore, but here is just one to show that there are opportunities even when forex has yet setup with good trades. 32, S&P500 shorts and target just about there. Small time frame trades like that are littered on all charts.

Tuesday, 2 June 2015

eur/gbp

Had some time away from the posting to catch up on other things and time I answered some emails here rather than individually which would take a long time.

If you cannot see where to look for entries and still need help, review my old posts. There is plenty information in those posts, and no I cant tell you where to enter or why, yout trading decision is yours and yours alone.

No, I do no offer a signals service and have none I can suggest to you. Learn to trade yourself and be self sufficient for life.

Mentorship is not something I do.

Onwards...........

Monthly chart of eur/gpb.

indicator line shows what price has been waiting for, back to the source of the move to fill more long orders. The bearish move has been halted and the early signs on this time frame of a possible turn are showing. This is my ten mile high view.

Weekly chart.

Following on from the above chart we can see prices reaction and the first reasonable bullish move take place. Price then hit near term supply and fell back again into what may become the final place for pro money to go long. So far they are showing interest. They will also know there are less sell orders nearby and it should be an easier ride up to the next supply area, which has already been spiked and if that is broken, it will also break a range and leave plenty room for upside profit. Round figures of .77 for that target.

Daily chart.

A closer in view of pricer action. It is very obvious we have not made lower lows and we have made one higher high on the 7th of May. While price did drop off from here, the higher high is a significant event to be mindful of.

4hr chart.

Marked is recent supply and a horizontal line showing a good area to watch. The second last candle here has punched well into and through supply, but look at the reaction. Very little interest from the bears.

1hr chart.

Again I show the candle that has pierced through supply and the lack of selling taking place in what would normally be a treasure trove of short orders waiting to be filled. The time was not ideal, but the NY session was and still is in full flow as I type this and still no appearance of any bears. Hmmm.

5 min chart.

As an added measure to drive this home to you some more, can anyone see the selling in the box?.....I cant.

If we see a break test and continuation tomorrow, there will be plenty scope for profit about with a target far enough away from pro money to be keen on exploiting. The exploited will of course be the retail trader and wait for any potential entries to be crystal clear and where it is best to see them i.e above current price and no doubt about direction.

One final comment, a lot of effort (money) has gone into that spike up that you can see. Someone wants a pay day for that and its presence where it is telling a story. Normally I like to see a supply area such as this hit hard and into the area by a good margin. This allows pro money hide the fact that they are very active here. And yes we see activity, but no follow through long or short. But look at what you see, the spike did not bring in sellers which I/we would have expected.

When we dont see happen what we expect, it is time to watch and wait. And while you wait there are numerous questions you ask of yourself. If I were pro money and spent all that money on the large spike to go short, and did not go short. What purpose was the spike and how will I make money back and with profit?

We know that in order to have any good movement in price we need pro money to push it, and that happens by getting plenty orders filled in places where the majority of the herd will see the opposite picture. There are places on this chart where price could show that to the herd. A mini sell off would be useful, but knowing we had two opportunities on the daily, and each failed to push lower, any short position would be unwise unless there is a break of the daily low chart with a failed pull back. The Euro is also gaining strength against many currencies and great care needed in case one is biased to only being short.

If you cannot see where to look for entries and still need help, review my old posts. There is plenty information in those posts, and no I cant tell you where to enter or why, yout trading decision is yours and yours alone.

No, I do no offer a signals service and have none I can suggest to you. Learn to trade yourself and be self sufficient for life.

Mentorship is not something I do.

Onwards...........

Monthly chart of eur/gpb.

indicator line shows what price has been waiting for, back to the source of the move to fill more long orders. The bearish move has been halted and the early signs on this time frame of a possible turn are showing. This is my ten mile high view.

Weekly chart.

Following on from the above chart we can see prices reaction and the first reasonable bullish move take place. Price then hit near term supply and fell back again into what may become the final place for pro money to go long. So far they are showing interest. They will also know there are less sell orders nearby and it should be an easier ride up to the next supply area, which has already been spiked and if that is broken, it will also break a range and leave plenty room for upside profit. Round figures of .77 for that target.

Daily chart.

A closer in view of pricer action. It is very obvious we have not made lower lows and we have made one higher high on the 7th of May. While price did drop off from here, the higher high is a significant event to be mindful of.

4hr chart.

Marked is recent supply and a horizontal line showing a good area to watch. The second last candle here has punched well into and through supply, but look at the reaction. Very little interest from the bears.

1hr chart.

Again I show the candle that has pierced through supply and the lack of selling taking place in what would normally be a treasure trove of short orders waiting to be filled. The time was not ideal, but the NY session was and still is in full flow as I type this and still no appearance of any bears. Hmmm.

5 min chart.

As an added measure to drive this home to you some more, can anyone see the selling in the box?.....I cant.

If we see a break test and continuation tomorrow, there will be plenty scope for profit about with a target far enough away from pro money to be keen on exploiting. The exploited will of course be the retail trader and wait for any potential entries to be crystal clear and where it is best to see them i.e above current price and no doubt about direction.

One final comment, a lot of effort (money) has gone into that spike up that you can see. Someone wants a pay day for that and its presence where it is telling a story. Normally I like to see a supply area such as this hit hard and into the area by a good margin. This allows pro money hide the fact that they are very active here. And yes we see activity, but no follow through long or short. But look at what you see, the spike did not bring in sellers which I/we would have expected.

When we dont see happen what we expect, it is time to watch and wait. And while you wait there are numerous questions you ask of yourself. If I were pro money and spent all that money on the large spike to go short, and did not go short. What purpose was the spike and how will I make money back and with profit?

We know that in order to have any good movement in price we need pro money to push it, and that happens by getting plenty orders filled in places where the majority of the herd will see the opposite picture. There are places on this chart where price could show that to the herd. A mini sell off would be useful, but knowing we had two opportunities on the daily, and each failed to push lower, any short position would be unwise unless there is a break of the daily low chart with a failed pull back. The Euro is also gaining strength against many currencies and great care needed in case one is biased to only being short.

Sunday, 29 March 2015

eur/gbp

A few of you emailing me are taking trades without looking at the higher time frames that sneak up on you. Because the weekly and monthly unfold at such slow pace relative to all the daily action, it is far too easy to not pay enough attention to them and get taken by surprise.

Here is a break down on the eur/gbp on how it has reached a major swing low point and its bullish recovery in the near term.

First up is the monthly chart.

Price has fallen sharply and hit the blue line, which as you should know be now is where we last saw major buyer step in and break out from a long term range. The last candle has not yet closed, but given we only have a few trading days remaining in the month I do not see it pushing down much more than it has.

Weekly chart.

A little more information on this chart to help guide our eye and make sense of what we can see. The upper blue line is support and resistance and has been a reactionary area in the past and one we look for again in the future.

The lower blue line is taken from the monthly chart of where we saw buyers step in some time ago. Note the clean and rapid move away, a clean indication of lots of buy orders coming in at once. The range between the blue lines is 750 points and is appealing for pro money to work towards. Price will not go in a straight line between these areas and once a trade is managed correctly there will be multiple entries and exists all the way to the ultimate target.

One area to watch for as price rises is around the small box drawn. This could be a place where pro money take profit, allow price to drop back and load up again. But we shall wait and see and trade what we see and not what we think.

Daily chart.

We now get to see a lot more detail and the day traders actions. First thing to look at is how price pushed through the S/R line with relative ease, the market players are all still bearish and no buyers turning in to prevent price continue falling.

As price falls we see a retracement inside the box, the top of this box looks to be a useful place when price returns to that area. There has been clean price action on top and again as price pushed back up into it. But when price eventually left the box, note is slow meandering pace. Clearly there has been no major selling which is telling when you know price has been rapidly approaching major time frame demand.

Price hits the lower blue line which is monthly demand and there is no way I will stand against a monthly bull. You just simply will get wiped out if you try. Now that price has changed its track and its pace, you can see this in the candle stick price action where the upward momentum has over taken what was bearish momentum. There has been two deep pull backs and were useful as a means to test for selling. The current candle and the next red candle previous to this clearly shows how the test for sellers failed and the bulls ran with it. Pro money wont fight the market and instead will constantly test for opposing traders in areas where they know the probability of their entries costing more money than they wish to spend is great.

4hr chart.

This is a common time frame along with the daily for me to use as my guide and help gauge what is going on. Much of the market noise from the lower time frames doesnt show up here and its a cleaner time frame to look at.

First thing to note, it doesnt look like it at first glance, but the current move up has taken around half of the major 750 point range out already. The herd wont even have noticed this and the media wont pimp it until we are close to the upper portion of the range. No doubt spurred on by pro money to give a good news story which gets retail traders in a good mood and all will make money as price rise for a few days or a week or so, and then the pro money start the sell off and take their profits. I wont predict anything, but if the bullish move continues I will expect to see some nasty price action on the upper part of the range to allow long stops taken, new shorts placed and subsequent reversals to take their stops. It is the same age old techniques over and over again, yet the herd fall for this and have continued to fall for it over 100 years. You would think folks would learn to take what I call my ten mile high view before jumping in.

The two tests I mentioned in the previous chart are clearer here. I placed a set of black lines showing the test for sellers which also hits near term demand, deliberate?....you betcha. Think like a pro and get as many tasks done for the lowest possible risk and price as you can and once you see this happening in real time, the result should show their intent, which was take price higher here.

Last item to mention on this chart, look at the box, this represents a daily reversal of price. See how price fell, but the fall was not selling, but a test for sellers, into demand, price reverses and back into the recent origin. There is little value in looking beyond this because the market was closing and no reliable intel can be gained from the remaining few candles.

1hr chart.

I am placing this here only to show how the lower time frames appear to show you different information. What we know as a test for sellers appears to show a bearish trend coming back in. But the reply from the buyers at the lower blue line shows other wise and all of this is coming in at areas we would expect it, whereas a real selling trend would have broken the demand. Again, once the origin of that last move happened, we ignore the market close and wait for some new intel to show us what the next setup will be.

5min chart.

Now we are down to the main time frame just about all of you trade. The intel you get here can be highly useful if you pay attention to the higher time frames. As price reaches the areas we have identified before price has reached them, we drop down to this time frame and look for entries.

First up, this chart shows the daily reversal and how it looks on the 5min chart. We see supply on the left playing out which is a test for selling and on this time frame folks will say, but there is selling. If all you trade is the 5min chart in isolation, then yes it is selling, until you get stopped out at the bottom. Ok say you, I will let price hit the most recent supply and go short again, fine. But not the most recent supply was taken out and so was your stop, so this cannot be selling....again.

If you had the patience and knew something was not right about the supply being broken and watched for a while, you would see price come down very slowly off the most recent broken supply. If the selling was to continue it would not be as slow as this. Note where the slow price down ends up and finally takes off in strong bullish mode?.....into near term demand, and this was done before price reached recent supply because the intent from pro money was to use that chosen area as the place from which to send price higher for a low cost to them, but knowing the herd wont see it and will have orders to the contrary.

Supply when broken can become demand, just like resistance can. In this instance we see a real clever move that looks like it will be tried again.

You make have to think about this chart and its price action for some time, it says a lot more than I can given the time it takes me to get charts up here and emails out on occasion.

Ten mile view.

This is a zoomed out weekly chart. I have placed it here to let you see why has reacted in the way it did. Note the lowest blue line which I will also place in my next chart of the weekly, but zoomed in.

Weekly zoomed in.

My last comment was to take note of the lowest blue line and I will work from top left to lower right down to this line.

I tried to get some additional intel into this chart but cant fit it all on screen, and so the best I can say to you is that just prior to candle 1 was a push through of previous demand. We know now there was no interest in taking the last clean demand and the buyers did not show up. This means there is a change in sentiment from what would normally have happened. Ok, lets move to what the candle mean by number in the context of lack of interest from the buyers and clear signs from the broken demand of some selling showing up as wicks on the candles prior to 1.

1 pushed up into a previous bullish candle that closed more than 50% of its overall length and was taking short orders off what would have been demand, but below the demand price. You can refer to the other charts to see this.

2 Smart move by pro money, take out the high of 1 but close on its own lows. This was a false break and pulled in more low cost shorts, the herd got shafted again.

3 An inside bar, or to put it another way in logical speak. Activity that has done nothing to further price movement in any way outside of the previous bar. By bar I mean candle and its years of taking bars and not candles still has it come out, anytime you see me say bar, it means candle sticks given the chart type I favor.

4 Test for buyers into the low of 1. Some showed up but did not result is higher price and the bar closes on its lower half. It also closes lower than 2 and 3.

5 Pushes lower and closes toward its highs, but still remains an inside bar with respect to 1.

6 Opens and pushes higher in dramatic fashion, will have gotten the herd long, then reverses and closes on its lows and closes outside of 1. The range established by 1 and contained by 2 thru 5 has been broken. We know lots of failed bulls got stung and the bias is now bearish.

7 Opens at the low of 6 and pushes higher, but closes near its open. Result, no buyers of any significance.

8 Opens and pushes strongly down into monthly/weekly support and bounces off, but closes at the lowest price yet. The small wick shows no interest from buyers.

9 Looks insignificant but it pushes above the wick of the previous two candles and aided by the reaction off 8 as being bullish. We know this is no longer true and was another attempt at getting long orders in the market and reverse it yet again, which they did.

10 A strong push through monthly/weekly support and a clear sign the bulls have no hope left, not that they did for some time. This will have gotten many bears in the market and this cannot be allowed continue because it is not profitable long term for pro money. We close off the lows only by a small amount.

11 The counter punch, pro money take price higher to take out all the new short orders and given this went on for a week it will also have attracted a lot of new long orders who will have seen the previous week as a false break and reverse positions. Result, we close on the lows with the most powerful candle yet and close to the bottom of a historic pull back area which is way out of the chart to the left. Price slows as it reaches this.

12 Part of the pull back and the close nearer the highs is not buying.

13 Reaction of the market was the push above the highs of the previous candle as an aid to giving the illusion of a market turn, but closes at its lows and the herd get stung again. Sound familiar?

14 Break of the small range formed by the previous two candles and is pro money loading up for the final leg down.

15 Make it appear there is no interest in taking it short by closing well off the lows and a small real body with no reasonable distance of price falling. Easily over looked is the fact price has closed lower.

16 This is not surprising given there has not been any long term place on the chart to support buying and price has no option only fall again. The blue line it cut through and closed below was from an old reaction point way back. Given it managed to get through it and not have any reaction to it invalidates that point in the future. It had only one reaction before and we wont concern ourselves with it now.

17 The wick on top shows the market is being slowed prior to its touch down at major time frame demand. The danger in allowing the market fall too hard and too fast is that it would cost pro money a bundle to maintain the structure they see from historic order areas and greatly effect profits. There are trillions every day in these charts and you should be able to see that when major areas fail, it will cost some of the pro money players serious money and put others out of business. The wicks you see here are with an easy 100's of billions alone.

18 Touch down. A picture perfect hit to major time frame demand and just look at the tail and close. It doesnt show up any clearer than that and the structure has been held in tact and gives security to pro money that now they can start on the next market phase.

19 Big time reverse and close strongly not far from the highs. If I didnt mark the major time frame demand area the close of this candle would appear as a push up into near term supply and load up with more short orders.

20 The current candle and not yet closed. We are close to this months end and you can see supply has been hit and yet price still sits up there nice and high.

I could write volumes more on each candle, but as it stands it takes enough time to get posts up here and I hope the reasons you now see on longer time frames will influence how you judge the market on lower time frames.

What appears chaotic has order. Once you draw into your charts ahead of time these reactionary areas, you want to see pro money active around them. Then you wait for the test, which will come if you give it time. Most of you still need to learn a lot of patience and not run after price. Emotions will break your account and your mind if you let them. Be cold and calculating and wait for price to come to you where you have already decided that this is a place where I will take great interest and watch for it to react.

Here is a break down on the eur/gbp on how it has reached a major swing low point and its bullish recovery in the near term.

First up is the monthly chart.

Price has fallen sharply and hit the blue line, which as you should know be now is where we last saw major buyer step in and break out from a long term range. The last candle has not yet closed, but given we only have a few trading days remaining in the month I do not see it pushing down much more than it has.

Weekly chart.

A little more information on this chart to help guide our eye and make sense of what we can see. The upper blue line is support and resistance and has been a reactionary area in the past and one we look for again in the future.

The lower blue line is taken from the monthly chart of where we saw buyers step in some time ago. Note the clean and rapid move away, a clean indication of lots of buy orders coming in at once. The range between the blue lines is 750 points and is appealing for pro money to work towards. Price will not go in a straight line between these areas and once a trade is managed correctly there will be multiple entries and exists all the way to the ultimate target.

One area to watch for as price rises is around the small box drawn. This could be a place where pro money take profit, allow price to drop back and load up again. But we shall wait and see and trade what we see and not what we think.

Daily chart.

We now get to see a lot more detail and the day traders actions. First thing to look at is how price pushed through the S/R line with relative ease, the market players are all still bearish and no buyers turning in to prevent price continue falling.

As price falls we see a retracement inside the box, the top of this box looks to be a useful place when price returns to that area. There has been clean price action on top and again as price pushed back up into it. But when price eventually left the box, note is slow meandering pace. Clearly there has been no major selling which is telling when you know price has been rapidly approaching major time frame demand.

Price hits the lower blue line which is monthly demand and there is no way I will stand against a monthly bull. You just simply will get wiped out if you try. Now that price has changed its track and its pace, you can see this in the candle stick price action where the upward momentum has over taken what was bearish momentum. There has been two deep pull backs and were useful as a means to test for selling. The current candle and the next red candle previous to this clearly shows how the test for sellers failed and the bulls ran with it. Pro money wont fight the market and instead will constantly test for opposing traders in areas where they know the probability of their entries costing more money than they wish to spend is great.

4hr chart.

This is a common time frame along with the daily for me to use as my guide and help gauge what is going on. Much of the market noise from the lower time frames doesnt show up here and its a cleaner time frame to look at.

First thing to note, it doesnt look like it at first glance, but the current move up has taken around half of the major 750 point range out already. The herd wont even have noticed this and the media wont pimp it until we are close to the upper portion of the range. No doubt spurred on by pro money to give a good news story which gets retail traders in a good mood and all will make money as price rise for a few days or a week or so, and then the pro money start the sell off and take their profits. I wont predict anything, but if the bullish move continues I will expect to see some nasty price action on the upper part of the range to allow long stops taken, new shorts placed and subsequent reversals to take their stops. It is the same age old techniques over and over again, yet the herd fall for this and have continued to fall for it over 100 years. You would think folks would learn to take what I call my ten mile high view before jumping in.

The two tests I mentioned in the previous chart are clearer here. I placed a set of black lines showing the test for sellers which also hits near term demand, deliberate?....you betcha. Think like a pro and get as many tasks done for the lowest possible risk and price as you can and once you see this happening in real time, the result should show their intent, which was take price higher here.

Last item to mention on this chart, look at the box, this represents a daily reversal of price. See how price fell, but the fall was not selling, but a test for sellers, into demand, price reverses and back into the recent origin. There is little value in looking beyond this because the market was closing and no reliable intel can be gained from the remaining few candles.

1hr chart.

I am placing this here only to show how the lower time frames appear to show you different information. What we know as a test for sellers appears to show a bearish trend coming back in. But the reply from the buyers at the lower blue line shows other wise and all of this is coming in at areas we would expect it, whereas a real selling trend would have broken the demand. Again, once the origin of that last move happened, we ignore the market close and wait for some new intel to show us what the next setup will be.

5min chart.

Now we are down to the main time frame just about all of you trade. The intel you get here can be highly useful if you pay attention to the higher time frames. As price reaches the areas we have identified before price has reached them, we drop down to this time frame and look for entries.

First up, this chart shows the daily reversal and how it looks on the 5min chart. We see supply on the left playing out which is a test for selling and on this time frame folks will say, but there is selling. If all you trade is the 5min chart in isolation, then yes it is selling, until you get stopped out at the bottom. Ok say you, I will let price hit the most recent supply and go short again, fine. But not the most recent supply was taken out and so was your stop, so this cannot be selling....again.

If you had the patience and knew something was not right about the supply being broken and watched for a while, you would see price come down very slowly off the most recent broken supply. If the selling was to continue it would not be as slow as this. Note where the slow price down ends up and finally takes off in strong bullish mode?.....into near term demand, and this was done before price reached recent supply because the intent from pro money was to use that chosen area as the place from which to send price higher for a low cost to them, but knowing the herd wont see it and will have orders to the contrary.

Supply when broken can become demand, just like resistance can. In this instance we see a real clever move that looks like it will be tried again.

You make have to think about this chart and its price action for some time, it says a lot more than I can given the time it takes me to get charts up here and emails out on occasion.

Ten mile view.

This is a zoomed out weekly chart. I have placed it here to let you see why has reacted in the way it did. Note the lowest blue line which I will also place in my next chart of the weekly, but zoomed in.

Weekly zoomed in.

My last comment was to take note of the lowest blue line and I will work from top left to lower right down to this line.

I tried to get some additional intel into this chart but cant fit it all on screen, and so the best I can say to you is that just prior to candle 1 was a push through of previous demand. We know now there was no interest in taking the last clean demand and the buyers did not show up. This means there is a change in sentiment from what would normally have happened. Ok, lets move to what the candle mean by number in the context of lack of interest from the buyers and clear signs from the broken demand of some selling showing up as wicks on the candles prior to 1.

1 pushed up into a previous bullish candle that closed more than 50% of its overall length and was taking short orders off what would have been demand, but below the demand price. You can refer to the other charts to see this.

2 Smart move by pro money, take out the high of 1 but close on its own lows. This was a false break and pulled in more low cost shorts, the herd got shafted again.

3 An inside bar, or to put it another way in logical speak. Activity that has done nothing to further price movement in any way outside of the previous bar. By bar I mean candle and its years of taking bars and not candles still has it come out, anytime you see me say bar, it means candle sticks given the chart type I favor.

4 Test for buyers into the low of 1. Some showed up but did not result is higher price and the bar closes on its lower half. It also closes lower than 2 and 3.

5 Pushes lower and closes toward its highs, but still remains an inside bar with respect to 1.

6 Opens and pushes higher in dramatic fashion, will have gotten the herd long, then reverses and closes on its lows and closes outside of 1. The range established by 1 and contained by 2 thru 5 has been broken. We know lots of failed bulls got stung and the bias is now bearish.

7 Opens at the low of 6 and pushes higher, but closes near its open. Result, no buyers of any significance.

8 Opens and pushes strongly down into monthly/weekly support and bounces off, but closes at the lowest price yet. The small wick shows no interest from buyers.

9 Looks insignificant but it pushes above the wick of the previous two candles and aided by the reaction off 8 as being bullish. We know this is no longer true and was another attempt at getting long orders in the market and reverse it yet again, which they did.

10 A strong push through monthly/weekly support and a clear sign the bulls have no hope left, not that they did for some time. This will have gotten many bears in the market and this cannot be allowed continue because it is not profitable long term for pro money. We close off the lows only by a small amount.

11 The counter punch, pro money take price higher to take out all the new short orders and given this went on for a week it will also have attracted a lot of new long orders who will have seen the previous week as a false break and reverse positions. Result, we close on the lows with the most powerful candle yet and close to the bottom of a historic pull back area which is way out of the chart to the left. Price slows as it reaches this.

12 Part of the pull back and the close nearer the highs is not buying.

13 Reaction of the market was the push above the highs of the previous candle as an aid to giving the illusion of a market turn, but closes at its lows and the herd get stung again. Sound familiar?

14 Break of the small range formed by the previous two candles and is pro money loading up for the final leg down.

15 Make it appear there is no interest in taking it short by closing well off the lows and a small real body with no reasonable distance of price falling. Easily over looked is the fact price has closed lower.

16 This is not surprising given there has not been any long term place on the chart to support buying and price has no option only fall again. The blue line it cut through and closed below was from an old reaction point way back. Given it managed to get through it and not have any reaction to it invalidates that point in the future. It had only one reaction before and we wont concern ourselves with it now.

17 The wick on top shows the market is being slowed prior to its touch down at major time frame demand. The danger in allowing the market fall too hard and too fast is that it would cost pro money a bundle to maintain the structure they see from historic order areas and greatly effect profits. There are trillions every day in these charts and you should be able to see that when major areas fail, it will cost some of the pro money players serious money and put others out of business. The wicks you see here are with an easy 100's of billions alone.

18 Touch down. A picture perfect hit to major time frame demand and just look at the tail and close. It doesnt show up any clearer than that and the structure has been held in tact and gives security to pro money that now they can start on the next market phase.

19 Big time reverse and close strongly not far from the highs. If I didnt mark the major time frame demand area the close of this candle would appear as a push up into near term supply and load up with more short orders.

20 The current candle and not yet closed. We are close to this months end and you can see supply has been hit and yet price still sits up there nice and high.

I could write volumes more on each candle, but as it stands it takes enough time to get posts up here and I hope the reasons you now see on longer time frames will influence how you judge the market on lower time frames.

What appears chaotic has order. Once you draw into your charts ahead of time these reactionary areas, you want to see pro money active around them. Then you wait for the test, which will come if you give it time. Most of you still need to learn a lot of patience and not run after price. Emotions will break your account and your mind if you let them. Be cold and calculating and wait for price to come to you where you have already decided that this is a place where I will take great interest and watch for it to react.

Saturday, 7 March 2015

eur/usd

Time for a new post, or well over due from the emails I received over the past few weeks. I dont wish to post up new charts just for the sake of rehashing what has already been said. However, many of you want to see more of what I look for and here is a break down of the recent Euro action with the US Dollar.

My ten mile view is shown here together with horizontal lines showing places where I expect price to react in the future. We have broken below major support and resistance which is above the highest blue line. I am sure you can all see this without me pointing it out.

The lines have been drawn at the first area where price could react, and in reality price is going to have plenty room within a range of prices where it will unfold what is in the minds of pro money. Where price breaks from a range it is best to draw a box over the entire range. I have placed lines here to help keep the charts cleaner looking and easier to read.

Weekly chart.

The upper blue line is where price had the opportunity to take a breather and go higher. The pro's decided there is better profit to be had below and price got pushed hard through this potential area for a small reversal. This is good intel in that there will be lower prices to come for some time yet. Look on the above chart for those areas.

The lower line is taken from a bullish move way back in 2003. Even now it has an effect and prices from years back will have the same effect. Major price swings on higher time frames produce better moves that this one and we are forming one to the down side as I type this and it appears to have a few months left in the overall move down.

Daily chart.

This is now the most viewed time frame for most of the worlds major money firms. I have drawn a small black line in to show a range price formed and eventually broke lower from. Given that no bullish interest was in the market, pro money has to create the illusion of buying in order to load up. What you see are a few strong individual days where long bullish candles show plenty buying.

But as I mentioned in the past, a question you always ask of yourself before taking a trade is, who am I buying from if I go long here at this price?

The answer for a valid trade must always be, the herd or the retail trader. I will throw in some banks and hedge/pension funds into that too, even some of those folks chase price. Dumb move.

When price sets into these ranges you have two options open. Either have the capital to withstand the days of price going against you, or get out with some profit and wait for the continuation. If the bullish move was genuine you would see price make progress to the upside. All we see here is price getting push back down the following day.

It should come as no surprise that when the break by the bears is made, price moves away quickly. There were two days when entries short showed up with two small green candles. Given price was here not long ago and failed to go higher, we know that there cannot be enough buyers at this price area to push price higher and logic has to come into play.

4hr chart.

A little closer in on the price action and this break out of the bottom of the range is clean and just look at the tiny bullish reaction in the two green candles. Clearly no buyers here and pro money know from this there are no long trades in their way and all that is now required is time to get more orders placed before the big push happens.

Three candles after the last of the two little green candles you see how they achieved this. A nice long spike into the candle that broke the bottom of the range and this took out all shorts, got the foolish long and netted enough orders to allow the market just fall quickly soon after. If you measure the points in that candle you can see how most stops will have been taken out. Most traders wont be able to take that kind of expensive draw down. The gutted feeling of getting taken out and then see the market go in the direction they had figured is a real head wrecking for lots of people and I hear it all the time. Worst of all is, on the next trade the same traders want to get even with the market and double down on the trade to make back the loss and get more profit than before. Thats nothing more than a fast way to destroy and account. Each trade has to be taken on its own merits and have a know entry, target and stop.

1hr chart.

On this chart I have shown the candle which removed short stops and was a clear sign of pro money taking this lower. The candle went deep into the body of the candle that showed the range above was broken and such significant moves do not just happen, all this is carefully planned and executed.

15min chart.

This zoomed out chart is to show you where taking trades from the top of a range in a bearish market is the only place to take lowest risk trades. The blue line is taken from the monthly chart above and see how it is still holds true. knowing ahead of time for all of these places is an invaluable piece of information. The price action that unfolds are price reaches these areas tell the story of continuation to the down side.

5min chart.

This is the same as the above chart on the 5min time frame and a little closer in again. Note the move away from the blue line, it is quick clean and no disputing pro money does not want to take this higher. As price moves away it eventually drops off dramatically. This is the clearest sign that anyone could spot and its only a matter of time before the pro's bring price back slowly checking for buyers and also to see if more short orders will come in as price gets close to where it originally broke from. The small black line is the absolute origin and many times it wont get that far into the original break. Another short there was low risk and a stop either above the black line or above the blue line. The risk/draw down is a factor of your position size and how much heat you can take.

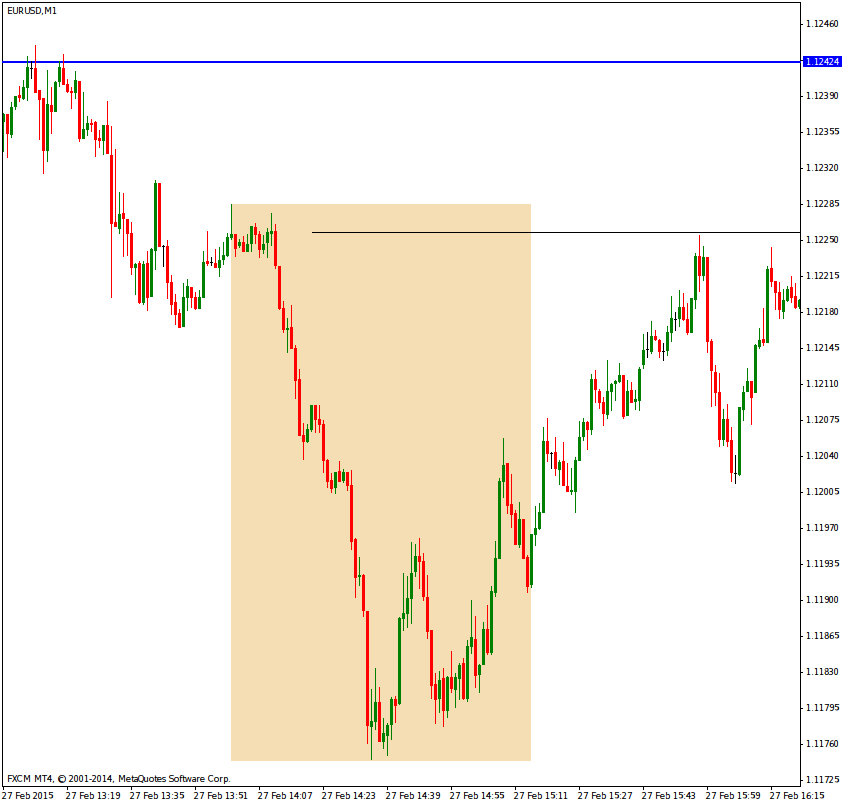

1min chart.

Just for the fun of it.

This is the time frame that sends most folks to the emergency ward at the local hospital and trading this is for the quick and accurate out there. I am showing this so that you can see the price moves all line up in this time frame from the 4hr down to the 1min. The reaction away from the blue line and the subsequent move away from the black line to the most recent supply is very obvious and easily tradable.

Now that you know where price is and that the probability of more bearish activity is strong and that parity is a nice juicy target, it is for you to make the next calls as price reaches those areas. Price always falls faster than it rises. In order for their to be bullish activity there must be not only enough long orders to push it up, price must also be supported or else the market will drop off. For short selling there is no need for any kind of support because most people are naturally negative and creating an environment for fear/panic etc is all too easy to do with the media taking up the lead on the fear/panic stories and trying to tell folks that the news drives the markets. No, the markets is what make news and not the other way around!

My ten mile view is shown here together with horizontal lines showing places where I expect price to react in the future. We have broken below major support and resistance which is above the highest blue line. I am sure you can all see this without me pointing it out.

The lines have been drawn at the first area where price could react, and in reality price is going to have plenty room within a range of prices where it will unfold what is in the minds of pro money. Where price breaks from a range it is best to draw a box over the entire range. I have placed lines here to help keep the charts cleaner looking and easier to read.

Weekly chart.

The upper blue line is where price had the opportunity to take a breather and go higher. The pro's decided there is better profit to be had below and price got pushed hard through this potential area for a small reversal. This is good intel in that there will be lower prices to come for some time yet. Look on the above chart for those areas.

The lower line is taken from a bullish move way back in 2003. Even now it has an effect and prices from years back will have the same effect. Major price swings on higher time frames produce better moves that this one and we are forming one to the down side as I type this and it appears to have a few months left in the overall move down.

Daily chart.

This is now the most viewed time frame for most of the worlds major money firms. I have drawn a small black line in to show a range price formed and eventually broke lower from. Given that no bullish interest was in the market, pro money has to create the illusion of buying in order to load up. What you see are a few strong individual days where long bullish candles show plenty buying.

But as I mentioned in the past, a question you always ask of yourself before taking a trade is, who am I buying from if I go long here at this price?

The answer for a valid trade must always be, the herd or the retail trader. I will throw in some banks and hedge/pension funds into that too, even some of those folks chase price. Dumb move.

When price sets into these ranges you have two options open. Either have the capital to withstand the days of price going against you, or get out with some profit and wait for the continuation. If the bullish move was genuine you would see price make progress to the upside. All we see here is price getting push back down the following day.

It should come as no surprise that when the break by the bears is made, price moves away quickly. There were two days when entries short showed up with two small green candles. Given price was here not long ago and failed to go higher, we know that there cannot be enough buyers at this price area to push price higher and logic has to come into play.

4hr chart.

A little closer in on the price action and this break out of the bottom of the range is clean and just look at the tiny bullish reaction in the two green candles. Clearly no buyers here and pro money know from this there are no long trades in their way and all that is now required is time to get more orders placed before the big push happens.

Three candles after the last of the two little green candles you see how they achieved this. A nice long spike into the candle that broke the bottom of the range and this took out all shorts, got the foolish long and netted enough orders to allow the market just fall quickly soon after. If you measure the points in that candle you can see how most stops will have been taken out. Most traders wont be able to take that kind of expensive draw down. The gutted feeling of getting taken out and then see the market go in the direction they had figured is a real head wrecking for lots of people and I hear it all the time. Worst of all is, on the next trade the same traders want to get even with the market and double down on the trade to make back the loss and get more profit than before. Thats nothing more than a fast way to destroy and account. Each trade has to be taken on its own merits and have a know entry, target and stop.

1hr chart.

On this chart I have shown the candle which removed short stops and was a clear sign of pro money taking this lower. The candle went deep into the body of the candle that showed the range above was broken and such significant moves do not just happen, all this is carefully planned and executed.

15min chart.

This zoomed out chart is to show you where taking trades from the top of a range in a bearish market is the only place to take lowest risk trades. The blue line is taken from the monthly chart above and see how it is still holds true. knowing ahead of time for all of these places is an invaluable piece of information. The price action that unfolds are price reaches these areas tell the story of continuation to the down side.

5min chart.

This is the same as the above chart on the 5min time frame and a little closer in again. Note the move away from the blue line, it is quick clean and no disputing pro money does not want to take this higher. As price moves away it eventually drops off dramatically. This is the clearest sign that anyone could spot and its only a matter of time before the pro's bring price back slowly checking for buyers and also to see if more short orders will come in as price gets close to where it originally broke from. The small black line is the absolute origin and many times it wont get that far into the original break. Another short there was low risk and a stop either above the black line or above the blue line. The risk/draw down is a factor of your position size and how much heat you can take.

1min chart.

Just for the fun of it.

This is the time frame that sends most folks to the emergency ward at the local hospital and trading this is for the quick and accurate out there. I am showing this so that you can see the price moves all line up in this time frame from the 4hr down to the 1min. The reaction away from the blue line and the subsequent move away from the black line to the most recent supply is very obvious and easily tradable.

Now that you know where price is and that the probability of more bearish activity is strong and that parity is a nice juicy target, it is for you to make the next calls as price reaches those areas. Price always falls faster than it rises. In order for their to be bullish activity there must be not only enough long orders to push it up, price must also be supported or else the market will drop off. For short selling there is no need for any kind of support because most people are naturally negative and creating an environment for fear/panic etc is all too easy to do with the media taking up the lead on the fear/panic stories and trying to tell folks that the news drives the markets. No, the markets is what make news and not the other way around!

Saturday, 24 January 2015

Eur/Jpy

A few emails lately came to me on price action within areas of interest and the approach price makes to those areas. In an attempt to answer this I will use a current price setup and show one of the ways pro money tried in and around these areas. It is important to note that there is no single method used by pro money and learning price action patterns and candle names etc will do you no good. Time and price tells the story and it is not to be treated as a technical or scientific method that you can prove 100% each time.

The point of this post is to have you open your mind about what has happened in the past and if we now see things that are setting up for a reaction in the same direction as history has shown us. The price you see on higher time frame charts are littered with pending and market orders in both directions, but pro money will hide ther intentions for as long as possible and can both time and money on their side.

They can either slowly or quickly push price into an area of interest, they can slowly or quickly push price away from that area, or they can push price through it in a false move, or keep it moving in that new chosen direction.

Another trick is to set price moving in a range. These range plays are dangerous places to enter and the longer price spends inside the range, the more spectacular the move out will be and will also move a long way.

Keep in mind that higher time frames turns tend to happen with the effort to turn price hidden in news releases. Bad news gets price to come down, but if price is already moving down the news does nothing only get price to its ultimate target faster that it would have otherwise. If price is approaching historic demand and the news is bad, the pro's will use this as a mechanism to buy into the selling from the herd, its a cheap and fast way to get lots of orders filled.

If price is moving up and price is already close enough to historic supply, the good news will get more retail traders long and give pro money plenty scope to sell into this news and fill lots of orders at a low price for their entries. What you should never do is expect good news or bad news to move the markets in the direction you think they will. Good news is an aid for selling and bad news is an aid to buying, typically.

If you look back through old price charts around times of major news releases, you will find many times the market had setup to move in that direction already. The news was simply a catalyst to the move.

Look at the Japanese Tsunami, a major bad news story and price fell. You may say of course it will be bad for the Yen and it had to fall. Sure, now looked where it stopped and reversed on a dime....thats pro money at work.

Rewiring your brain to where you can see what is at hand will be tough for a lot of you. It will be hard to buy when prices are falling and there is no sign of recovery i.e confirmation. It will be hard for you to sell when prices are reaching for the moon with no end in sight. These are the highly emotional price moves that pro money know will get you in at the worst time for you, and the cheapest prices for them. They can afford to allow the market go against them for some price range before they will finally cause price to turn.

None of you (or myself) have pockets deep enough to turn price and what we do is wait for the last signs of buying or selling before we enter. Apply logic to what you see on the chart.

If for example you see the market wants to turn from bullish to bearish, what would have to happen?

The logical thing is that buying must dry up, another logical thing is sellers must come into the market, logic again says we should test to see if there are any buyers left. How do we do that?....simple, stop your selling and see will any buyers step in and take prices higher, if prices move higher it means there are buyers still willing to take it and you do not yet have the cheapest price and easiest means to push price lower, if you do all it does is cost you more money than needs be.

This testing and retesting happens all the time on all time frames and all instruments traded. You wont find it mentioned in books because the authors of those books want you to get in on some price formation or pattern. A break of a head and shoulders etc. All that does is get you in long after the main move has happened. As for indicators, do yourself a favor and remove ALL of them because all are a twisted view of old price. They are not showing reality.

The tricks that will destroy your price reading for some time, will be the false moves. These will tug at your emotions and think an old area of supply has just been broken and will now become support and aid price to move up and now that you spotted this, you will go long early and catch the move. No!

You want to see sustained buying and little selling if its a true change in direction. Letting it go for a later test of that area is a safer option. It will prove who the major players are i.e bulls or bears and then on the later test you have a much safer and higher probability entry. This retest can be hours later, but thats fine, we can wait knowing we did not take a bad trade and want a low cost enter with low potential cost stop.

On the Euro/Yen pair there was a few hundred points in a days trading if you applied this logic. The pro's do the same kind of analysis and guessing, its constant testing, false moves etc just to see who is active in the market and what direction they want to go and with what amount of effort (money) behind them.

Perhaps an example of a frozen lake may help. If the weather has been very cold for a few days, the edges of the lake will freeze up first. You test the edge with your foot to see will it hold, you know the potential for the ice to give will be great and you wont place all your weight on the ice, just a gentle push. If it gives way you know there is no point in trying to do the same thing further in. This is the same as price, if you are testing for a direction you can see as potential, you want to see are there others doing the same as you, or others who are the polar opposite.

Lets say the ice is strong, you gain confidence and you place one foot on the ice and give a little down ward stab, the ice still holds, great you say. I will wait a little and try both feet only a few inches in from the edge, knowing that if I go through I wont come to any harm other than two wet feet.

You try both feet, and it holds. You jump up and down, it holds. Now you know the potential for the ice to have some thickness to it further out is now great. And you gradually work your way out. Eventually you see there are no more weak points and you happily get on with your ice skating/fishing etc.

The markets are the same, you watch for the pro's doing these tests and also the false moves which in themselves are nothing more than a test of a different type.

When price enters a range, these are the places where its best to ignore all tests and false moves and wait for price to break out and then test as it comes back close to the range. If it doesnt go back into the range there is a good chance we will see continuation.

Here is the monthly chart show price hitting and breaking supply to the left. The black line shows the price after it broke supply. Do you see strength in the price after it broke through?....all I see are a lot of attempts to push higher, and all failing. This can only mean one thing, there are not enough buyers at these prices, it is not worth placing money into a long position.

Look at A. This is the bearish candle where the true intention of pro money came in for us to see. We know that the move was strong, within one time frame and there will be some residue from that move. The candle close has also shown to setup a support and resistance area. We dont know this until price revisits the area. A few hints of this will be visible on lower time frames, but as always we start on the high time frames to see the ten mile view.

We can see price coming back into the S/R area and rapidly moves away. This is selling by pro money in very very large lots. Forget what you hear about price rejecting and area, this is complete nonsense. Price doesnt reject or accept anything, it is driven by order flow and that move seen on the chart is a sign of overwhelming supply, it rapidly gets orders filled and price has to move away quickly. There is nothing to reject, it is classic selling on a mass scale within a tiny amount of time at the price area. If more folks understood what order flow was, none of these useless words would be thrown about.

Here is the weekly chart.

As time unfolds lower down, we get more information. The B on top is supply and the move away shows a lot of selling also in a short amount of time. There can be no argument about who is in control. I have marked the origin of a push up on the left and its test to the right. Price action between both points is not selling on this time frame, it is just a long pull back and allows the pro's to reload for the final push in the overall move up into supply. The last push tends to be dramatic and very long and strong bullish candles get the herd buying like crazy. This is the ideal time to get such a move because all the long orders play into the hands of the pro's who know there is a very good selling opportunity coming soon and they can hide a lot of their short orders by selling to the herd, who are buying everything they can. Its lambs to the slaughter, but do you think you could not buy when you see this happening on a time frame more suited to day trading?.....probably not because price looks strong, great moves for a few weeks and your making a ton of money, they you see what looks like a pull back and all you do is wait for it to come down more, load up more for the continued move up and your all set.

First of all, look at what I called the last pull back, note the candles, all except one are bearish, look at the time taken, its a rapid move down. Look at what it broke, it has broken the test candle. You could be surprised how many people get taken by this, and even if this were a 5min chart, people will still stay in thinking its nothing more than a pull back.

Daily chart.

B still on top and shows where the sellers came into the market with great force. You can also see two attempts by the untrained to hold the market, there are two minor pull backs, and even if you were long here, if one pull back failed why stay in for that to be broken?

On the bottom blue line is our test candle, which was a test of the previous move up allowing the pro's to get that emotional bullish move going. I bet the news on TV was good and the stories telling us great things.

Price even here has had little in its way to break the test candle, which is also support. And as you know, once support is broken it then sets up to become resistance when price comes back.

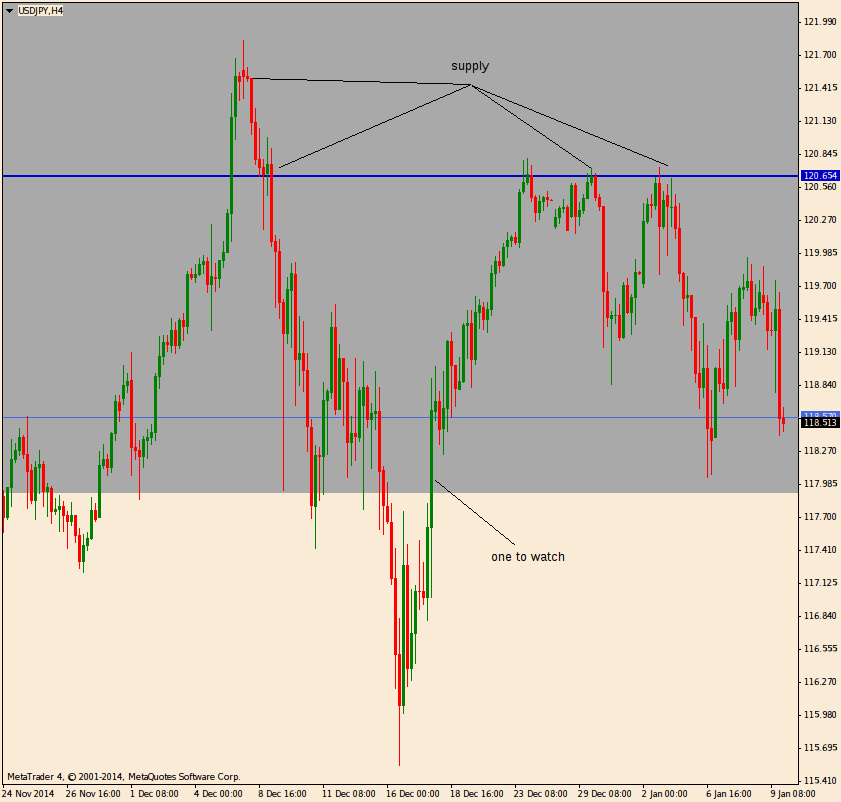

4hr chart.

Closer in again and a better look at price falling down into support. The little bounce off was not unexpected and the nice slow move up into the most near term supply gave enough low cost short orders for the bears to finally push price hard down through support. Plenty down side to follow and more yet once we see price come back up to allow the move continue.

A minor test of the break did happen and two candle show where it formed. We were getting close to end of the day/week and plenty profit taking tends to make price action look a little messy then. But the overall picture is pretty as it gets.

Here is a 5min line chart. I put this up just to help show you what real price movement vs pull back looks like, and in time you will see this on a candle stick chart in real time.

As price falls from the left of the chart, it stops and reverse quickly, they slowly winds its want up into the small horizontal black line. The black line is?......near term supply, look left and where the fall originated from and there is one target. We now were so close to the market closing that the subsequent moves wont be as clean, but there was some continuation down after supply was hit and given little in the way of buyers lurk below, we can see more shorting coming in next week.

For comparison here is a candle stick chart of the same 5min period. Where you see price wind itself up into supply, it also helps price fall later because most of the buyers will be gone and little to stop price falling.

If you have the patience to wait, or can develop it, you will do yourself a big favor and loose a lot less. Do not chase price, let it come back to where you want to get in and for a lower price in the overall move. If you time your entries with the 4hr and higher time frames, your chances of success go up by a great margin. Also take note of when pull backs or tests break previous established price areas of interest, if they are broken you are getting a heads up and pay close attention to what is coming.

You can take any time frame and you will see testing testing and pull backs happening in any active market. Remember that there must be active players in the market and the price movement and time taken both show you that. If you have access to volume from the futures markets it is also valuable intel because volume is activity. I dont say much about volume here because forex has tick volume and every broker will have a different volume feed and I wont be able to cover every brokers feed on a chart.

The point of this post is to have you open your mind about what has happened in the past and if we now see things that are setting up for a reaction in the same direction as history has shown us. The price you see on higher time frame charts are littered with pending and market orders in both directions, but pro money will hide ther intentions for as long as possible and can both time and money on their side.

They can either slowly or quickly push price into an area of interest, they can slowly or quickly push price away from that area, or they can push price through it in a false move, or keep it moving in that new chosen direction.

Another trick is to set price moving in a range. These range plays are dangerous places to enter and the longer price spends inside the range, the more spectacular the move out will be and will also move a long way.