Timely may be the correct word to use and come end of month, it will be shown if what we can see forming will transpire to be the turning point in this pair. Onto the monthly chart.

First thing to note is the current candle on the right edge is not fully formed and closed, it for the moment can only be considered a guide. But looking left of that candle shows us a bullish candle closing off its highs and in an area where there has been historic supply, and given the supply happend many years ago, there is a stronger suggestion that it may be a good place for pro money to consider selling once again. There is still upside potential and this has to be kept in mind until such time as all supply as been eliminated, as yet we are early to this party.

The small black horizontal line is where there was a break/test for a continuation of an upward move and was also ideally placed because we can see the area prior to that test was where pro money accumulated more long orders.

The weekly chart.

I have left the box on top to show were supply was present in the past and also the black horizontal line. One addition is the candle I have marked which is showing where pro money took price low in order to assist them to unwind positions but still maintain some upward momentum. I say unwind because on this time frame to my eye, it looks like the tide is starting to turn. This wont happen over night and so funny business is always going to happen before the weak hands are dealt a blow to their pocket.

Always ask, if we are in a strong trend how could there be such a large spike down. There has to be a reason for this and is strong historic supply enough of a reason, or are they loading up to push higher?....which would you favor?

The daily chart.

Now we see a different situation unfolding. The box for supply still present, as is the black horizontal line showing where price went and reacted off. The rapid turn back up shows still buyers willing to take it higher, but it failed to push above the most previous high, this is no longer a strong bullish move.

Where the black line is drawn I have marked a final push candle. It looks like a bearish candle with a long tail showing buying. It also has considerable volume when viewed on a futures chart. A little before this I have marked a candle entitled emotional push. Such strong candles are never good in a bullish or bearish market and are designed to tug at the retailers emotions and get them into the market now, or risk missing on the big move. The truth is the move is nearing an end and this is how money changes hands and direction in the greater scheme of things. The pull back into the horizontal line tells me that such a move is nothing more than a test to see if more buyers will step in and try for another leg up. This so far has failed to materialise.

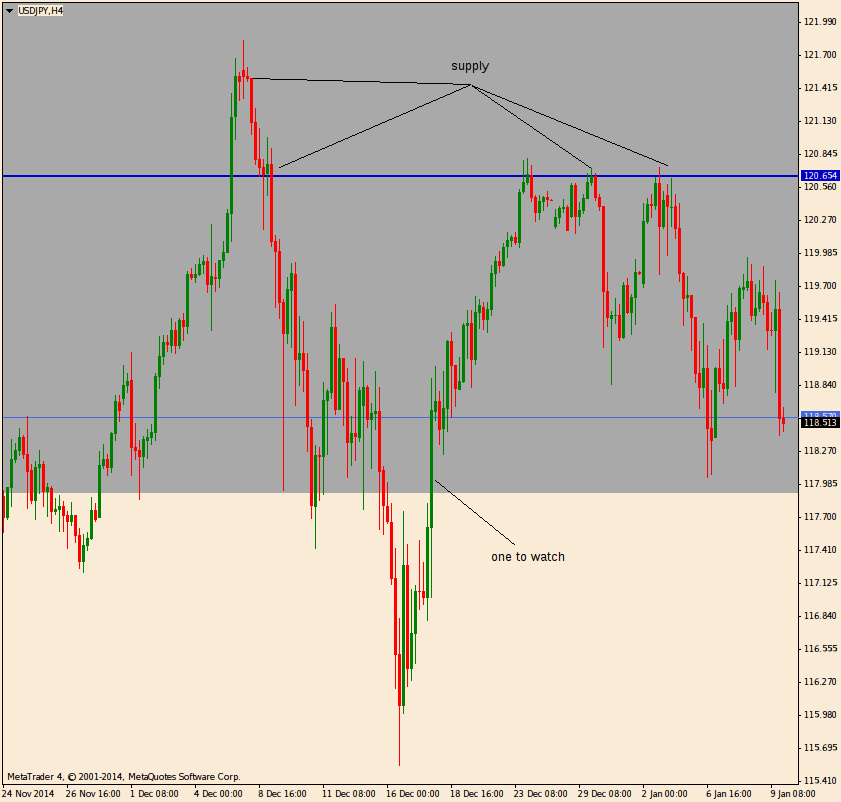

4hr chart.

Now we are getting close to the coal face. I marked where supply is coming in and also marked a blue line showing how it looks when viewed as an area. There is nothing on this time frame that shows continued bullish activity. But, and there is always a but. The bottom of the box has another candle I marked that is part of a wide range to be wary of. Some of the buyers in the candle have been taken out, yet others will still be present waiting. If too many buyers are still present as price falls, there may be the formation of a new range. It is a popular tactic to fake out, tire out and finally take out all those who who try to out smart pro money. If you are already in the right direction chosen by pro money, they will do the best to get you out with false moves, taking a long time to make the move, in hopes to get you out from boredom and you close your position, or they will kick off a false move to take you out. Which ever mechanism is used, you can either hold long term with a sensible stop, or else you are adding to their low cost entries.

Same holds true for pull backs, the deeper the pull back gets or the longer it continues, the more orders pro money can filter in.

1hr chart.

Overall we are in a bullish move, yet take note of the ease at which price can fall. The reaction from the bulls is pretty much mute and any reaction they do have, is slow and sluggish.

The same 1hr chart shown as a line.

Perhaps the move down being faster than anything the bulls can muster is easier to see.

Last up is the 5min chart and zoomed in a little.

In the middle of the chart is price pushing up into supply, this is no different to the previous charts where I also showed an emotional push candle that has the same effect on a different time frame. The reaction to all this mega buying is......a market turn. If you look at any time frame in isolation you will not see this move down was probable. Now that you can see it was probable and missed the first move down, where would subsequent entries make sense?

Well, how about at the break/test/continuation areas?

It tells more than just an entry, it tells us where have the bulls gone if they had some much force to push the market up that fast. The entire move up and its origin was nothing more than a false move designed to get folks long. Getting the retail trader long means low cost short entries for pro money and this happens on every time frame, every financial instrument since trading began.

Price rarely rise or falls immediately on the first break from the previous direction, the secondard test on higher time frames is where a lot of the main move is built from and its something to watch out for carefully. It is also the safest place to enter with a low risk. All you need to is develop the patience to wait for the price to pull back after a high time frame has unwound.

Put in the time to mark all your 4hr+ time frames for historic supply and demand and you will do yourself a great favour. As price changes direction eventually in one of those supply and demand areas you have to pay attention to how price action looks and where the opposing forces are gaining ground. At the supply areas you need to look for signs of distribution where the longs are getting out and where early signs of supply show up. On the bearish side where shorts are getting out, the instrument will be bought into and the same type of testing to see will areas hold and no further sellers available in great numbers, which no makes it easy/low cost for pro money to reverse the market.

By low cost/cheap, I of course mean cheaper. It is never cheap to turn any market and fractions of a penny in large enough volumes add up to significant investment.

It is a pointless activity and a waste of your time to look for certain candle formations, all it does is fill your head with useless information and take you away from what you should be doing, which is watch price move and how candles form. Pro money are not silly enough to push price to where it will form predictable candle patterns each time. That would defeat their agenda which is to either get you out of the market or get in well ahead before you notice. As I mentioned before, they will fake you out, stop you out or tire you out. Either one works and is proven to work for a long long time.

Arh.. thanks. doc. I have been waiting for this long.

ReplyDeleteExcellent Doc, thank you very much.

ReplyDeleteDoc,

ReplyDeleteOn your 5 min chart big push into supply, can we consider it like clening a supply for later move up maybe?

Xman

Didnt get in here for a few days and late for your comment now.

ReplyDeleteThe slow unwind still looks intact and there are moves afoot to push price lower. The rapid price moves up into near term supply has failed to break above any of those this year and the bearish reaction off of those near term highs is obvious.

The big move on Dec 16 is where the story will be told, its the last chance for the bulls and the bears know this. The smart way to slowly eat away the bulls appetite is to allow price come down slowly into those two large candles and then wait for the bulls reaction. Predictions are never a good thing, but it would make sense to have a nice rally off those candles to get the retail long for a day, then reverse it soon after. Its low cost entries and will have gained enough momentum to push through the area easily.

This comment has been removed by the author.

ReplyDeleteSo far all by schedules. :)

ReplyDeletexman