My ten mile view is shown here together with horizontal lines showing places where I expect price to react in the future. We have broken below major support and resistance which is above the highest blue line. I am sure you can all see this without me pointing it out.

The lines have been drawn at the first area where price could react, and in reality price is going to have plenty room within a range of prices where it will unfold what is in the minds of pro money. Where price breaks from a range it is best to draw a box over the entire range. I have placed lines here to help keep the charts cleaner looking and easier to read.

Weekly chart.

The upper blue line is where price had the opportunity to take a breather and go higher. The pro's decided there is better profit to be had below and price got pushed hard through this potential area for a small reversal. This is good intel in that there will be lower prices to come for some time yet. Look on the above chart for those areas.

The lower line is taken from a bullish move way back in 2003. Even now it has an effect and prices from years back will have the same effect. Major price swings on higher time frames produce better moves that this one and we are forming one to the down side as I type this and it appears to have a few months left in the overall move down.

Daily chart.

This is now the most viewed time frame for most of the worlds major money firms. I have drawn a small black line in to show a range price formed and eventually broke lower from. Given that no bullish interest was in the market, pro money has to create the illusion of buying in order to load up. What you see are a few strong individual days where long bullish candles show plenty buying.

But as I mentioned in the past, a question you always ask of yourself before taking a trade is, who am I buying from if I go long here at this price?

The answer for a valid trade must always be, the herd or the retail trader. I will throw in some banks and hedge/pension funds into that too, even some of those folks chase price. Dumb move.

When price sets into these ranges you have two options open. Either have the capital to withstand the days of price going against you, or get out with some profit and wait for the continuation. If the bullish move was genuine you would see price make progress to the upside. All we see here is price getting push back down the following day.

It should come as no surprise that when the break by the bears is made, price moves away quickly. There were two days when entries short showed up with two small green candles. Given price was here not long ago and failed to go higher, we know that there cannot be enough buyers at this price area to push price higher and logic has to come into play.

4hr chart.

A little closer in on the price action and this break out of the bottom of the range is clean and just look at the tiny bullish reaction in the two green candles. Clearly no buyers here and pro money know from this there are no long trades in their way and all that is now required is time to get more orders placed before the big push happens.

Three candles after the last of the two little green candles you see how they achieved this. A nice long spike into the candle that broke the bottom of the range and this took out all shorts, got the foolish long and netted enough orders to allow the market just fall quickly soon after. If you measure the points in that candle you can see how most stops will have been taken out. Most traders wont be able to take that kind of expensive draw down. The gutted feeling of getting taken out and then see the market go in the direction they had figured is a real head wrecking for lots of people and I hear it all the time. Worst of all is, on the next trade the same traders want to get even with the market and double down on the trade to make back the loss and get more profit than before. Thats nothing more than a fast way to destroy and account. Each trade has to be taken on its own merits and have a know entry, target and stop.

1hr chart.

On this chart I have shown the candle which removed short stops and was a clear sign of pro money taking this lower. The candle went deep into the body of the candle that showed the range above was broken and such significant moves do not just happen, all this is carefully planned and executed.

15min chart.

This zoomed out chart is to show you where taking trades from the top of a range in a bearish market is the only place to take lowest risk trades. The blue line is taken from the monthly chart above and see how it is still holds true. knowing ahead of time for all of these places is an invaluable piece of information. The price action that unfolds are price reaches these areas tell the story of continuation to the down side.

5min chart.

This is the same as the above chart on the 5min time frame and a little closer in again. Note the move away from the blue line, it is quick clean and no disputing pro money does not want to take this higher. As price moves away it eventually drops off dramatically. This is the clearest sign that anyone could spot and its only a matter of time before the pro's bring price back slowly checking for buyers and also to see if more short orders will come in as price gets close to where it originally broke from. The small black line is the absolute origin and many times it wont get that far into the original break. Another short there was low risk and a stop either above the black line or above the blue line. The risk/draw down is a factor of your position size and how much heat you can take.

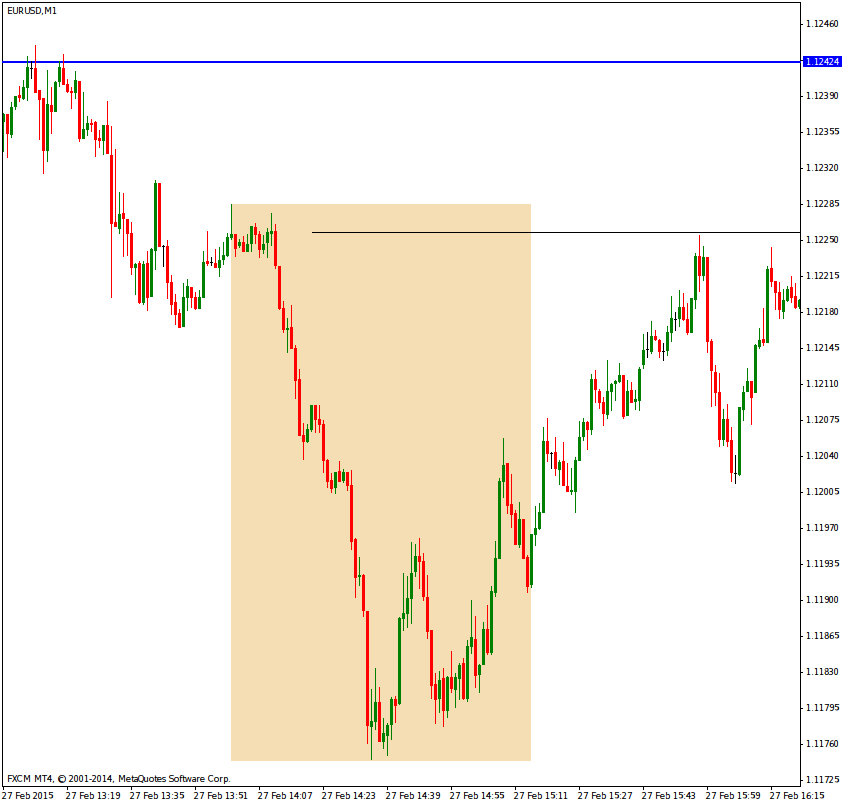

1min chart.

Just for the fun of it.

This is the time frame that sends most folks to the emergency ward at the local hospital and trading this is for the quick and accurate out there. I am showing this so that you can see the price moves all line up in this time frame from the 4hr down to the 1min. The reaction away from the blue line and the subsequent move away from the black line to the most recent supply is very obvious and easily tradable.

Now that you know where price is and that the probability of more bearish activity is strong and that parity is a nice juicy target, it is for you to make the next calls as price reaches those areas. Price always falls faster than it rises. In order for their to be bullish activity there must be not only enough long orders to push it up, price must also be supported or else the market will drop off. For short selling there is no need for any kind of support because most people are naturally negative and creating an environment for fear/panic etc is all too easy to do with the media taking up the lead on the fear/panic stories and trying to tell folks that the news drives the markets. No, the markets is what make news and not the other way around!

Excellent Doc, for me very ussefull.

ReplyDeleteThankc

xman

Glad you found it useful.

ReplyDeleteGreat blogpost like always.

ReplyDeleteI have a question but i am not sure how to frame it.

It is when you talk about H4 "Clearly no buyers here". The price was in a H4 Demand. Normally you don't see big moves up but a lot of fake before a reversal.

Just look at 10. Feb there was no sign of buying as well and yet it went up. So the only way to see where price goes is to wait for a big candle to breakout in either way.

My question would be how you can see that there is no buying instead of faking it to bring in more sellers?

I hope that was somehow clearly phrased.

Thank you

Thanks for the educational post. Doc. Now i can see clearly where the trading opportunities I missed.

ReplyDeleteBest regards,

Blacky

Distinction, 4hr demand is only there if you look at it in isolation. The bigger picture says we are bearish and no sign of it changing so far. If you look at how price pushed with ease through demand you can see how weak it was. It did not come as surprise to me and once that demand and potential support was broken, it will be tested to see will it hold and if more sellers come back, which they have by the boat load. Again, no surprises in any of that.

ReplyDeleteBlacky, plenty more to come and the market got a good shake up today and I expect the market to give plenty more opportunities after this nice move lower. As bear mode sets in to the retail traders head, I only wait for the direction to change and the areas are all clear to see where this can happen. For the moment I am heavily short the euro.

Thank you very much for your answer.

ReplyDeleteIt makes sense for the overall move but couldn't it go like 50 to 100 pips up before going with the overall move down?

I think that is my problem. You often see a candle at a lvl, say this is were for example sellers came in and it actually happened without any pullback.

When i try to do the same there is often a pullback that takes out a stop before going in the direction.

For example the H4 chart. Inbetween both blue lines. It broke the blue line than it came and touched it. The 5 and 6 candle after the blue line was touched.

It was a bear candle that closed under the last shortterm low. I would've gone short on the close of candle 6.

Would that be a good entry but just bad luck?

When price is in a clear down trend and is approaching a recent area where prices went higher, you should expect there to be some reaction with bullish orders coming in, simply because there was some buying there before, but the buying was not enough to change the overall trend and will also have been partially a result of profit taking and lower time frame traders using the opportunity to scalp long.

ReplyDeleteThink logically and you will find that this small move up will take out short stops, as well as the profit taking and lower time frame longs which all add to how far it will go. The big players wont load up until they are sure there are as little long orders to be filled before they regain control and load up more short orders. The cheapest place to go short is at high price and thats why pull backs will keep going until more short orders in this case are in the market and the next leg down happens.

At the time of writing I can see the euro into a near term supply area on the 1min chart. Market timing is off to see the same sudden reaction because no major markets are open. Keep you eyes on how the candles form and how the close. From what I still see there is nothing showing me buying in any great volume coming in which can only mean lower prices will continue until we see otherwise.

The clearest areas where pull backs tend to reach are on higher time frames for the majority of quality moves. The lower time frame areas wont have the same punch to them and unless its for example in the London session I wont pay much attention to them. You need activity in the market to show pro money at work, nobody else has the pockets to make the moves happen.

Stick to the trend and it will keep you out of a lot of trouble. And be sure that all orders counter to the trend are not present before getting back in.

Thank you very much. Appreciate that you take your time to answer me.

ReplyDeleteI think i got it except one thing.

Pullbacks can happen a lot. Again in the H4 chart between both blue lines. It could have pulled back two more times. Or it couldv'e broken out immediately.

Was there something that says the pullbacks are over and pro money are fully back or is it just a feeling you have after trading a long time?

I hope i don't bother you to much. Again really appreciate the answers you already gave me.

Regards

It will keep pulling back until there is the tipping moment where all buyers have had enough and there are more short than long orders in the market, then price will fall because it has to. You must wait for the signs that show in price action for this to come about. Then you weigh up your risk and if you get in on a particular time frame or on a particular price.

ReplyDeleteA few days has passed since my first post and the Euro continues to fall and most of the pull backs are now showing as tight price ranges and given we are in a bear market the only way to trade those is when taken off the top of the range and a stop at your risk appetite limit placed above.

Some traders will take a touch trade, which is an entry as soon as price reaches a historic price and set a wide stop and a target. I prefer to see price react in the direction I want at those areas and then I want to see it ideally tested to make sure there are no orders against me before I get in. This is how pro money works and why risk any money unless you have very good intel on the probability of orders against you are very low.

You can gauge this is the time price spends moving away at the reactionary area and how long it takes to test the area from where it moved away. Nothing but screen time will get this in your head and it would be unwise of me to show you candle formations of this happening, because there are many ways in which the candles can form and you will only distract yourself from where the real importance in this is, which is price.

Again as I type this price on eur/usd is 1.0550 approx and I now expect a retrace. Lets wait and see if I get my retrace and if I do, I will wait for the up move to fail and add more short positions.

Thank you very much.

ReplyDeleteYes trading from the top is what i want to do.I guess i am just scared price won't make a retest and i go in to early or rather with the first sign that it might be short now.

I will watch old reactions and try to get a feeling for it.

Thank you for help, Doc.

Regards

When the turn eventually comes you want to see the move being sustained and that shows intent for it to continue. The move will also look different to the pull back in that the candles will have larger bodies and the progress prices makes will be markedly more than the pull back.

ReplyDeleteAny retests are best when it is done where the disinterest from pro money is obvious. It will take time for your brain to see this, but given enough time there is no reason why you cannot see it.

My comment from earlier today has come to be, and price did pull back and no sustained buying can be seen and now I expect the bottom of the newly formed range to fail and price continue. When this will happen is always known and the probability is that it will happen.

As always trade what you see and not what you think. But when what you think has become reality, now you can proceed with confidence.

Correction to my above post.

ReplyDeleteWhen this will happen is always known and the probability is that it will happen.

This should say unknown....and excuse the typo's from my rapid typing. Open and active markets get my full attention and not my typing.

Hi everyone haven´t posted for a long time. I´ ve been absorbing and trading. So far so good actually.

ReplyDeleteHere´s what I think I am having troubles with. It sort of ties in what have been said earlier.

Can I ask how does this conincide with your "Time frame within time frame" post from last year where you describe how to take entries and your definition of trend?

I think I´m having troubles identifying when a range is forming within a trend. I.e. G/U could I not have said that on this pair a bull trend have been developing, according to "Time frame within time frame" (March 2014)? I know you don´t want to give specific definitions and I know why that is, but you do take your information from a certain time frame at least 4h as I understand? Or is it the 4h within a higher time frame? Because, as has been said before we can be long and short at the same time on different time frames. So we actually need to see a proper break either up or down where highs or lows are taken out and not just higher lows for bull trend or lower highs for bear trend?

Looking forward to your response

Please?

DeleteFirst of all thanks as always for answering Doc. I think i got it a little better. I guess in the end the answer would be patience and long term trend.

ReplyDeleteHello ChristianFx,

i am not sure i can answer it. I think you should look at the next lvls that are close. In a daily it might be a pullback to the closest supply and in the h4 and lower it looks like an uptrend. So it is rather simple. G/U at the 12th was a pullback to a H4 flip or a Daily supply.

Again i am not sure if this was even your question but i thought i should atleast try.

Regards

True, yes. I guess it´s a question of which and how many time frames one´s aligning. The monthly and weekly certainly weren´t bullish I know that.

DeleteYou now see why I start with high time frames and work down. As each time frame lines up with the others, it means big moves will soon follow.

ReplyDeleteLet the move happen on a few low time frames and get in on a pull back, risk is then minimal and reward very good.

Haha, yes. thanks

DeleteHello Doc,

ReplyDelete"Let the move happen on a few low time frames and get in on a pull back, risk is then minimal and reward very good."

This is what i will focus on :D

Hello Doctor:

ReplyDeleteThanks again for the lovely post and efforts to educate us. Would be very handy if you could share a few charts, explaining the previous comment of yours. Am referring to:

"Let the move happen on a few low time frames and get in on a pull-back..."

Regards

Krishna

See m15 m5 m1 charts in this post. You can get in on pullbacks from these timeframes depending on your risk.

DeleteHello Doc,

ReplyDeleteit has been a while. Not sure if you will read this :D.

I have a question. When you feel like it could you post a chart of yours where a trade didn't work?

Proper analyse but it just didn't worked out.

I think it might be really useful and helpful.

Either way thank you for this great site.

regards

Distinction