The time is here once again to get more content online and while I know you all crave more information, I detest those who have been collecting my data and selling it without my permission. All content on this blog is exclusive my content and its copyright is protected. If I see more of this selling taking place this blog will end and will be replaced with a paid members only access solution and that comes at a cost to everyone including my time which is more valuable to me than any website.

There are no reproduction rights granted or inferred to anyone to use what is on this blog. Clear enough?...ok lets move on.

EUR/GBP monthly

Back to basics, this is our ten mile high view and from this we want to know what direction price has come from and where it is going to. What we can see is price has come from a high peak back in December of 2008 and has fallen with very deep pull back to the origin of the entire move.

The lowest thin blue line shows the upper range of the origin and the warning to you is, there is additional room below for price to fall if pro so desires. From this upper part of the range we also see price reacted bullish on two occasions with the most recent rise in price coming into the most near term recent supply as shown with the thick blue line. While it is not yet end of the current month and the last candle yet to close, all we can see is price is willing to push again upwards.

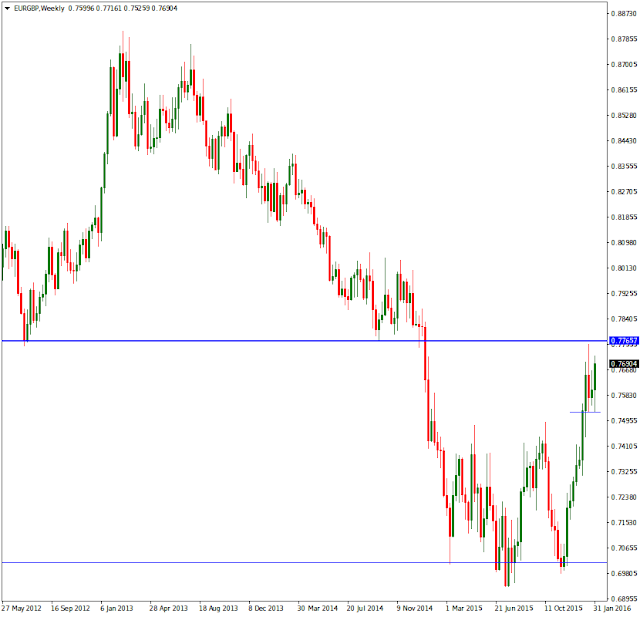

Weekly chart

Useful additional data shows up each time we drop down in a time frame. We see how price pinned the lower part of the supply over head and no major bearish follow through. The week ended with price ending up close to the high range of the weekly candle.

A little lower I have a thin blue line and this forms the lower range of a new price range that has setup. This range around 250 points and more than ample to become of interest for day trading if we see a fall. The thin line is a place where buyers appeared that were not there in big numbers when price fell to the left on the way down. Useful intel to be aware of.

Daily

With yet more detail we can see that not only is price again into supply, with even more supply over head on higher time frames, it is important to know where buyers would come in if price were to fall and if their buying is enough to not only support price and prevent bears from pushing lower, but if there is enough interest from pro money to break supply in a significant enough way to show us they are bullish and in control. On this chart it is a waiting game with no immediate trade setting up. Unless you trade with crystal clear targets for entry and exits, you only give money to those who are more than willing to take it.

The lower angled blue lines show historic buying, more bullish orders will be hiding in those candles and as yet we dont know the quantum of the force behind them. Time will show us once we are patient.

4hr

This is one of my go to charts for trading, it is between long term and short time frames and has clear information most of the time. Over all we can see a range setup that is roughly 230 points wide, that is plenty for day trading and most of you here are day traders. We always look for what I call, room for profit. Unless there are clearly defined and obvious room in one direction and its in tune with higher time frames, then we consider the interest pro will have to be greater than if the room for profit was say 50 points. The point count has no formula or rule, it is a guide to help you make better decisions.

What else can we see, clearly price has been to the bottom of this range twice and on each occasion it moved away quickly indicating there was lots of buy orders waiting there. If price took longer to move away it would show that the interest from the bulls was lack luster.

At 'A' arrowed, we see the most recent significant supply where sellers came in with force and pushed the market hard down to the lower part of the range. We are now at the close back into this supply area and some more information comes our way, take of the move away from supply. We see a lot of buying came in on the 3rd last candle. Ask yourself, if there was so much selling before and price moved away rapidly, and now I see price move away, buy be bought into hard, does this mean new buyers appeared to push price higher?

At this moment the answer is no, what happened is price was prevented from falling and some support came in. This move will have taken out many day trader bears and got others long at the wrong time. The time is wrong because any trade taken there was right into the market close for the week and you do not want to hold forex over a weekend, and ideally not held even over night unless you can handle the games that happen by pro money.

If price were to fall from here there is a box below which is the only point that would interest me. Buyers remain there and with good conviction as indicated by the clean break and swift move up. This plays well into the bigger picture that looks bullish and it also gives me a large room for profit and likely outside of the top of the range. We know this because much of the over head supply has been taken out and those orders for the most part are gone.

1hr

For interests sake I will throw up a 1hr chart and show you what I am looking at. Where price is currently all it tells me is that the price action is terribly chaotic and lots of dumb folks trying to get price to break up or break lower. Logic suggests the best move is lower and back down near the box below. But, if you look at the arrow A, you will see some spiky moves that has taken bullish orders from the box. The candle A is where any sensible longs look most reasonable once we see pro money showing is the way. Any break up from where price is now is a fools game and best left to run until we break supply and find a good place for support to show up.

Ranges are fine to trade is they are wide enough and if there has been a good amount of time since the last tough of the extreme edges. There is nothing to say price has to respect the edges and always keep in mind that the time will come with either side of the range will fail and price will move away from there quickly, aiding in that move and all the stops that get taken out, break out traders who run after price, and new short orders that were waiting below, or in the case of a bullish break, long orders waiting above. I do not advocate break out or chasing trades, its a fools game.

15min

To drive the point home even more, does the blue line show you enough to say, buyers?....if they appear again it will be in or around the candles shown. Just be wary of the spiky nature of forex and that they can hurt stops if you are not careful and can go deeper into an range in order to get more orders filled.

Food for thought and I hope this is if benefit to you and help you tune your brain and eye to where orders lay.

I cannot take emails looking for comments on charts, it would be a full time job in itself. If some of you really want a private place to discuss trading, I will consider it, but only in a secure, private and considered method.

Be well,

Doc

thank you doc... for yet another great insight of the market

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThanks to you, I'm a better trader.

ReplyDeleteThanks Doc,

ReplyDeleteMay the new year bring you and yours good health and happiness!

Joe

I remember your first articles on forums - seems an eternity ago, when in order to understand your post it took me several readings, it is now all cristal clear at first reading.

ReplyDeleteThank you for everything Doc, hope to read more.

ps: who are those fraudster that are selling your stuff ? Subject them to the public ridicule

Everyone learns at a different pace and it can take more than one method of describing it before it sinks in and makes sense. It is good to hear that all is now clear for you.

ReplyDeleteThe only sure way to deal with thieves is to cut off their supply of swag.

Happy for your coming back Doc. Wish you all best.

ReplyDeleteEG broke out of the top of the range, without out too much sign of "buyers" coming in near the top... There did however seem to be a lack of selling interest to an extent. Presumably enough orders were filled lower down on the weekly that not too much reaccumulation was necessary and the lack of committed selling was the sign the range would break.

ReplyDeleteYou're right about e-mails for sure, apologies for that request, I think I was just excited to see you had a blog and were still active after finishing your journal. Would be really nice to have a chatroom or forum or something though.

Thanks! :)

Patience.

ReplyDeleteToday's price action shows a deep spike into supply as yet, no major reaction from the bears. Tomorrow we look for a test of the large bullish candle on the 4hr.

What is muddying the waters is the stacked and unclean looking supply from Dec 2014. High volume also kicked in as the peak of today's action.

Doc, thanks for the charts, comments and replies. Just a question about the pairs you trade. On the RTM forum you stated that you don't normally trade JPY. Personally I have been looking at, I think, far too many pairs. Would you be able to share some comments on which pairs we should avoid and why.......if your time permits.

ReplyDeleteThanks

Rob

You're a legend Doc! Thanks for all time you put into helping other traders like myself!

ReplyDeleteCheers

Gary